Status: Governor Brian Kemp has officially signed HB 148 into law, creating a new pathway to CPA licensure in Georgia!

BY BROADENING PRACTICE PRIVILEGE MOBILITY THIS BILL WILL:

Expanding the pathways to obtaining a CPA license in Georgia AND broadening practice privilege mobility to ensure a more flexible and accessible accounting profession.

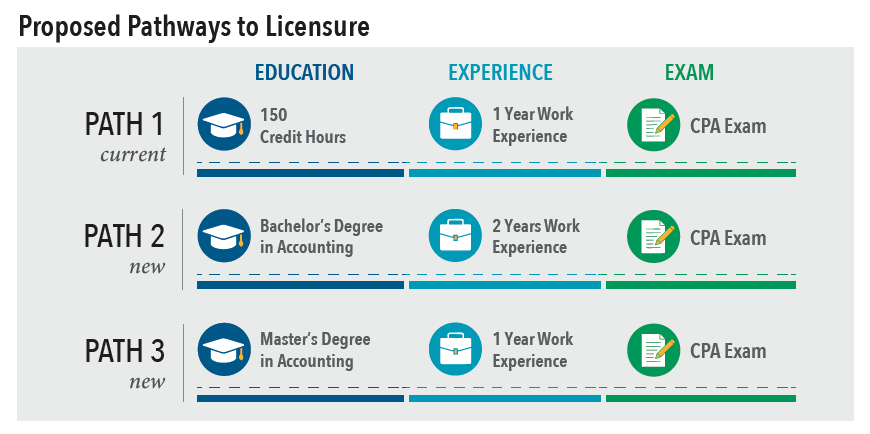

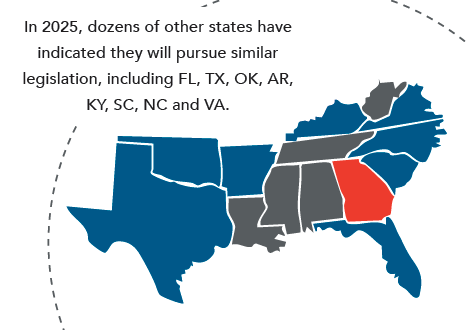

The Certified Public Accountant profession in Georgia is navigating significant challenges due to pipeline shortages, shifting demographics, and the evolving landscape of financial and audit standards. The current licensure framework, established in 1998, has not kept pace with these changes and is no longer meeting the needs of the profession. While maintaining the existing CPA licensure pathway, House Bill 148 seeks to address these demands by introducing two additional licensure pathway options AND broadening practice privilege requirements for out-of-state CPAs to practice in Georgia. These changes aim to modernize the licensure process, support the accounting profession’s growth, and allow qualified professionals to seamlessly contribute to Georgia’s business community without unnecessary barriers. Simply put, this is good for Georgia business.

ALL THREE PATHS: The Candidate must have a minimum concentration in accounting and business, as prescribed by the Georgia State Board of Accountancy.

BY ADDING PATHWAYS THIS BILL WILL:

- Provide Flexibility: Accommodates student needs and career paths.

- Reduce Barriers: Eases the financial and time burdens of a fifth year in college, thereby reducing barriers to licensure.

- Promote Workforce Development: Broadens the CPA candidate pipeline to meet the growing demand for accounting professionals in businesses, government and capital markets.

BY BROADENING PRACTICE PRIVILEGE MOBILITY THIS BILL WILL:

- Strengthen existing interstate mobility laws in Georgia by providing clarity and certainty.

- Make it clear that – if an out-of-state CPA has a license in good standing in their home state, meets education requirements put in place by the Georgia State Board of Accountancy and has passed the national CPA Exam, they are welcome in Georgia without any need for a second state license.

- Ensure Georgia businesses have access to any needed expertise that might just happen to be located outside our state borders.

Support from Local Leaders

REPRESENTATIVE JOHN CARSON, CPA:

“Expanding the pathways to the CPA license and broadening practice privilege mobility is vital to ensuring that Georgia remains a competitive and attractive place for accounting professionals. By offering more flexible routes to licensure, we empower a range of candidates to enter and thrive in the

CPA profession, which in turn strengthens our state’s economy and business landscape.”

BOYD SEARCH, CEO, THE GEORGIA SOCIETY OF CPAS:

“The new pathways to CPA licensure and expanded practice privilege mobility are essential steps toward addressing the growing demand for skilled accounting professionals. By allowing greater access to licensure and enabling CPAs to move freely across state lines, Georgia is positioning itself as a leader in the profession, ensuring that we continue to attract top talent from both within and outside the state.”

EMILY FARRELL, CPA, CHAIR, THE GEORGIA STATE BOARD OF ACCOUNTANCY:

“In today’s dynamic economy, it’s crucial that we evolve our licensing standards to meet the changing needs of both the profession and the businesses we serve. These added pathways and the broader practice mobility are key to maintaining Georgia’s reputation as a hub for accounting excellence and will help foster a more sustainable future for the profession.”

QUESTIONS?

If there are any questions on the above information, contact Don Cook, vice president, legislative affairs at 404-877-2154 or dcook@gscpa.org.

RESOURCES:

CPA Licensure: Current Landscape and Resources

Download the HB 148 Fact Sheet

Recording of HB 148 House Regulated Industries Subcommittee Hearing