Hurricane Tax Relief Update for Georgia CPAs

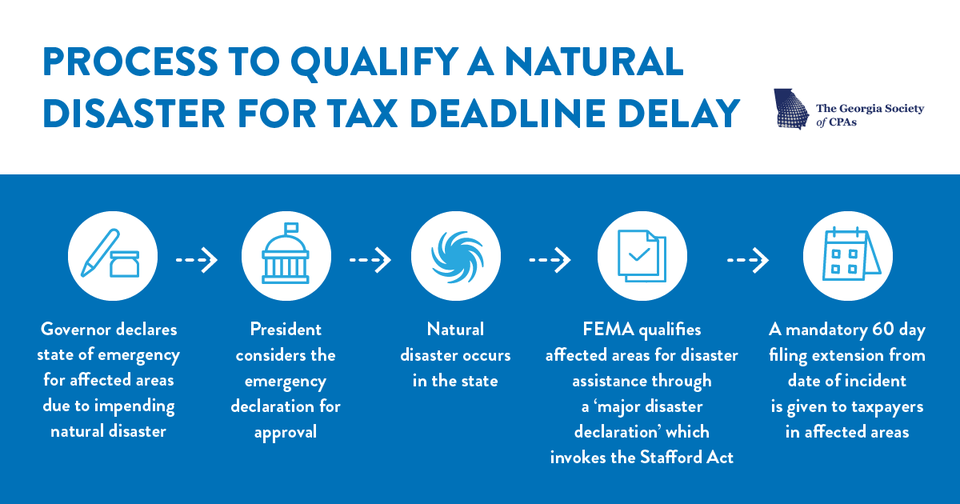

Ever wonder what the process is to qualify a Natural Disaster for Tax Relief? The Georgia Society of CPAs (GSCPA) has you covered! This infographic walks you step by step through the process. GSCPA actively advocates for relief from both state and federal agencies on behalf of our members, specifically when disasters strike!

Let’s recap the current tax relief status here in Georgia due to Hurricane Debby and now Hurricane Helene. The IRS has previously announced tax relief for victims of Hurricane Debby for these Georgia counties: Appling, Atkinson, Bacon, Ben Hill, Berrien, Brantley, Brooks, Bryan, Bulloch, Burke, Camden, Candler, Charlton, Chatham, Clinch, Coffee, Colquitt, Cook, Crisp, Decatur, Dodge, Echols, Effingham, Emanuel, Evans, Glynn, Grady, Irwin, Jeff Davis, Jefferson, Jenkins, Johnson, Lanier, Laurens, Liberty, Long, Lowndes, McIntosh, Mitchell, Montgomery, Pierce, Richmond, Screven, Tattnall, Telfair, Thomas, Tift, Toombs, Treutlen, Turner, Ware, Wayne, Wheeler, Wilcox, and Worth. The deadline has been postponed to February 3, 2025. These taxpayers now have until Feb. 3, 2025, to file various federal individual and business tax returns and make tax payments. Read the IRS article here: IRS announces tax relief for victims of Hurricane Debby in Georgia; various deadlines postponed to Feb. 3, 2025 | Internal Revenue Service

Additionally, the Georgia Department of Revenue (GA DOR) has also extended to February 3, 2025, for Georgians impacted by Hurricane Debby in the same counties. Affected taxpayers who had a valid extension until October 16, 2024, to file their 2023 return will now have until February 3, 2025, to file their return. Read the GA DOR article here: DOR Offers Tax Relief For Georgians Impacted By Hurricane Debby | Department of Revenue

Let's recap the current status of Hurricane Helene and tax relief for the counties that need it and that are NOT already covered under Hurricane Debby. Referencing the graphic above, Governor Kemp has already declared a State of Emergency for the entire state of Georgia. Additionally, President Joe Biden has already declared a State of Emergency for the entire state of Georgia. President Biden’s declaration has already invoked the Stafford Act, so GSCPA is actively seeking official confirmation from the IRS and the GA DOR on the counties that will receive tax relief from Hurricane Helene.

Read Governor Kemp’s Declaration here: Gov. Kemp Declares State of Emergency, Activates State Operations Center Ahead of Helene | Governor Brian P. Kemp Office of the Governor (georgia.gov)

Read President Joe Biden’s Declaration here: President Joseph R. Biden, Jr. Approves Georgia Emergency Declaration | The White House

In terms of Foreign Bank Account Report (FBAR) Filing Extensions as well as Beneficial Ownership Information (BOI) Filing Extensions from both Hurricane Debby and Hurricane Helene, GSCPA has just sent a letter asking the Financial Crimes Enforcement Network (FinCEN) for relief. Read the letter here.

Stay tuned right here for more information on further tax relief for Georgia counties, as well as FBAR and BOI extension information. We are working for you!